When you're dealing with financial documents that need to cross borders, you're not just translating words—you're translating trust, legality, and critical financial data. Financial translation services are designed to ensure that every number, term, and legal nuance in your documents is perfectly understood in another language and within another legal system. This isn't just about swapping out words; it’s about preserving the exact financial and legal meaning of complex information, which is absolutely vital for international business, legal matters, and official applications like immigration.

Decoding Financial Translation Services

Think of it this way: a general translator is like a family doctor—knowledgeable across a broad range of topics but not a specialist. A financial translator, on the other hand, is the cardiac surgeon you call when the stakes are incredibly high. They bring a deep, specialized understanding of finance, accounting principles, and the specific legal regulations of multiple countries to the table.

This kind of specialized service is a must-have in all sorts of situations, from massive corporate mergers to pivotal personal life events. For example, when a U.S. company is looking to acquire a firm in Germany, they need perfectly translated audit reports to get a true picture of the company's financial health. On a more personal level, an individual applying for a U.S. Green Card will need a certified translation of their bank statements from their home country to satisfy strict USCIS requirements. A certified translation is an official document accompanied by a signed statement from the translator, confirming its accuracy and completeness for bodies like USCIS.

Why Precision is Non-Negotiable

In financial translation, even a tiny error can snowball into a disaster. A single misplaced decimal point in a financial statement could turn a profitable quarter into a massive loss, instantly spooking investors. A misunderstood term in an investment prospectus might lead to drawn-out legal battles and heavy financial penalties. For an individual, an inaccurate translation of a tax return could get a mortgage application rejected or stall an immigration case indefinitely.

The global translation services market, which covers these critical financial needs, was valued at USD 956.81 billion in 2025 and is expected to hit USD 1.18 trillion by 2035. This boom shows just how much our interconnected world relies on precise financial communication. You can explore more on this market growth and its drivers.

In financial translation, there is no room for ambiguity. Every word must be precise, compliant, and contextually perfect to protect against financial loss, legal liability, and regulatory sanctions.

Common Financial Documents Requiring Translation

Accuracy is paramount across a wide spectrum of financial paperwork. Knowing which documents often need a professional touch can save you time and headaches, whether you're navigating international business, legal proceedings, or personal applications.

The table below outlines some of the most common documents we handle and explains why a flawless certified translation is so important for each.

| Document Type | Primary Use Case | Why Accuracy Is Critical |

|---|---|---|

| Bank Statements | Visa/immigration applications, loan approvals, legal proceedings | To provide undeniable proof of financial stability and a clear transaction history to authorities like USCIS or lenders. |

| Audit Reports & Financial Statements | Mergers & acquisitions, investor relations, corporate compliance | To ensure all parties have a transparent and accurate understanding of a company's financial health for due diligence. |

| Tax Documents | Cross-border tax compliance, audits, financial planning | To comply with local tax laws in different countries and avoid costly penalties or legal trouble with tax authorities. |

| Investment Agreements | International partnerships, venture capital, private equity deals | To ensure all parties fully understand their rights, obligations, and financial commitments, preventing future disputes. |

| Know Your Customer (KYC) Documents | Bank account opening, anti-money laundering (AML) compliance | For financial institutions to verify customer identity and financial history, meeting strict global regulatory requirements. |

Ultimately, these examples show just how essential professional financial translation services are. They act as a secure bridge, making sure complex financial information is conveyed with absolute clarity and integrity, no matter the language.

Request a certified translation today to ensure your financial documents meet global standards.

Navigating the Complexities of Financial Translation

Translating financial documents is a world away from simple word-for-word conversion. It’s a specialized field where a single mistake can have serious consequences. A true financial translation service doesn't just know languages; it understands the intricate dance of finance, regulation, and security. It's about having a specialist who can spot and solve complex issues before they turn into expensive headaches.

These challenges generally fall into four key areas, and each one requires a unique blend of linguistic talent and deep industry knowledge.

The Challenge of Specialized Terminology

Finance has its own language, packed with terms that often have no direct equivalent in other languages. Think about words like "equity," "derivative," or "amortization." These aren't just words; they represent complex financial concepts. A general translator might grab the closest literal translation, but a financial expert knows the principle behind the term and finds the correct local equivalent that carries the same weight and meaning.

For instance, if you're translating an American company's balance sheet for a Spanish investor, the term "retained earnings" needs to become "beneficios no distribuidos." Why? Because that's the phrase Spanish accountants and regulators recognize. Getting this right is the difference between a clear, compliant document and one that's dangerously misleading.

Precision in Numbers and Formatting

In the world of finance, numbers and how they're formatted are just as critical as the words surrounding them. A misplaced comma can change everything. One of the most common traps is how different regions handle decimal and thousands separators.

- In the United States, you'd write one thousand dollars as $1,000.00.

- But in many parts of Europe, that same amount is written €1.000,00.

Now, imagine a translator messes that up, turning $1,000.00 into €1,00. That's not just a typo; it’s a thousand-fold error that could render a financial report useless and create major legal or investment problems. If you're curious about how professionals avoid these pitfalls, our guide on how translation quality is assessed is a great resource.

Navigating Regulatory Compliance

Financial documents don't exist in a bubble. They have to play by very strict local and international rules. A translator needs to be fluent not just in languages, but also in different accounting standards, like the U.S. Generally Accepted Accounting Principles (GAAP) versus the International Financial Reporting Standards (IFRS) used in over 140 countries.

If a report is headed for a European regulator, it must conform to IFRS, which can be quite different from the original GAAP format. This means the translator isn't just swapping words; they are ensuring the document's entire structure and substance meet the target country's legal requirements. This is absolutely essential for audits, mergers, and any official filings.

A successful financial translation is one that is not only linguistically accurate but also legally and regulatorily sound in its new context. Ignoring local compliance standards is a risk that businesses and individuals cannot afford to take.

Upholding Strict Confidentiality

Last but certainly not least, financial documents are incredibly sensitive. They can contain anything from personal bank details for an immigration case to top-secret data for a corporate merger. Confidentiality isn't just a "nice-to-have"—it's a non-negotiable requirement.

Any professional financial translation service must have rock-solid security protocols. This means using secure platforms for file transfers, making every linguist sign a strict non-disclosure agreement (NDA), and maintaining robust data protection policies. It's a comprehensive approach to security, much like the best practices for safeguarding financial data during online transactions. When your financial future is on the line, you need to trust that your partner is treating your data with the highest level of care.

How Professionals Guarantee Translation Accuracy

When you’re submitting a critical financial report, how can you be absolutely sure it's accurate and will be accepted by institutions like USCIS? It’s not magic; it comes down to a deliberate, multi-step quality control process that seasoned professionals swear by. This system is meticulously built to catch every mistake, preserve the meaning behind the numbers, and produce a document that’s both linguistically perfect and legally sound.

It all starts with picking the right person for the job. We're not just looking for a fluent speaker; we're looking for a linguist with a verifiable background in finance or accounting. This kind of expert doesn't just translate words—they understand the concepts behind them, ensuring that complex terms are handled with the precise financial meaning they carry.

A Multi-Layered Quality Control System

Once the right expert is on the case, the real work begins. This is far more than a simple word-for-word swap. The translator uses specialized financial glossaries and termbases—think of them as custom-built dictionaries for the finance world. These tools ensure a term like "accrued liabilities" is translated correctly and consistently every single time, across every page.

But even after the initial translation, the document is far from ready. It immediately moves on to a second, equally critical stage.

A "four-eyes principle" is a non-negotiable standard in high-stakes translation. It simply means that at least two qualified experts review every document. This one step dramatically cuts down the risk of human error when dealing with complex financial data.

Another linguist, just as qualified as the first, conducts a full review. They act as a ruthless editor, hunting down any potential errors in numbers, terminology, or formatting. This is where a transposed digit in a bank statement or an incorrectly formatted date gets caught—the kind of tiny mistake that could get an official application rejected.

This layered approach ensures the final document is held to the highest possible standard. It’s the same level of diligence you’d demand from an accounting firm auditing your books.

The Final Seal of Approval

The entire process wraps up with the issuance of a Certificate of Translation Accuracy. This isn't just a piece of paper; it’s a formal declaration from the translation agency. It serves as a guarantee that the translation is a true and accurate reflection of the original document, handled by a qualified professional from start to finish.

This certificate is the seal of approval that most official bodies require, including:

- U.S. Citizenship and Immigration Services (USCIS) for documents like bank statements and proof of income.

- Federal and state courts for evidence submitted in legal proceedings.

- Universities for academic transcripts that include financial aid information.

- Financial institutions for loan applications or international account openings.

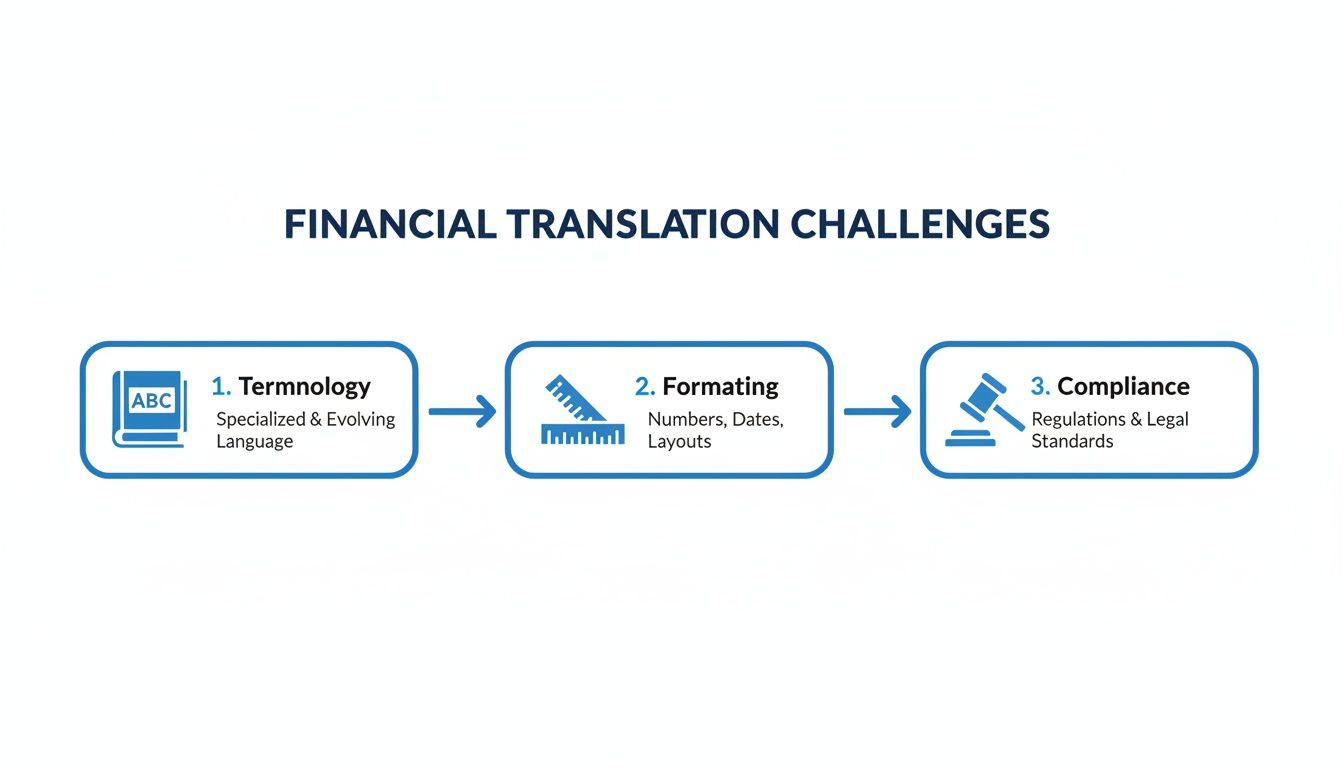

The infographic below shows the main challenges this rigorous process is designed to solve.

As you can see, professional workflows are structured to methodically tackle terminology, formatting, and compliance, leaving nothing to chance.

The demand for these meticulous financial translation services is climbing fast. The language industry is projected to grow from USD 64.99 billion in 2026 to USD 97.65 billion by 2031. Technology is a big driver here, speeding up workflows without cutting corners on quality. While software made up 72.88% of the market in 2025 by dramatically reducing project times, human oversight remains absolutely essential for the kind of accuracy needed in high-stakes financial and legal documents. You can learn more about these translation industry trends.

Ultimately, this professional system gives you the confidence you need for your most important submissions. If you need a translation that meets the strict requirements of immigration or legal authorities, take a look at our certified translation services page. Our process is built to deliver accuracy you can count on.

Understanding Certified and Notarized Translations

When you’re dealing with official documents—especially for financial, legal, or immigration matters—you'll constantly run into the terms "certified" and "notarized." They might sound interchangeable, but they serve completely different purposes. Getting this right is critical, because submitting the wrong type of validation can cause major delays or even get your application flat-out rejected.

What Is a Certified Translation?

Think of a certified translation as the gold standard for any official use here in the United States. It isn't just the translated document; it's a two-part package. You get the translation itself, plus a signed statement from the translator or translation company.

This statement, often called a "Certificate of Translation Accuracy," is a formal declaration. It attests that the translation is a complete and faithful rendering of the original source document, to the very best of the translator’s professional ability. It’s essentially a guarantee of quality and accuracy.

Imagine Maria is applying for her Green Card and needs to prove financial stability. She has her bank statements from Brazil, but they’re all in Portuguese. Before USCIS (U.S. Citizenship and Immigration Services) will even look at them, she needs a certified English translation. The certificate she submits gives the immigration officer confidence that all the numbers, dates, and transaction details are trustworthy. This is a non-negotiable step for almost all immigration paperwork.

What Is a Notarized Translation?

A notarized translation adds an entirely different layer of verification. In this process, a Notary Public—an official licensed by the state—watches as the translator or an agency representative signs the Certificate of Translation Accuracy.

It's crucial to grasp this key point: the notary does not check the translation for accuracy. Their sole function is to verify the identity of the person signing the certificate and to witness them signing it. The notary's stamp is an official seal on the signature, not on the quality of the translation itself.

While notarization is less common than certification for documents used within the U.S., it can be essential in certain legal situations. For instance, if you're submitting a translated financial agreement in a foreign court or dealing with certain international business contracts, the other party might insist on the extra formality of a notary’s seal.

When Do You Need Each Type?

Knowing which to ask for will save you a lot of headaches and money. Here’s a quick breakdown to help you figure it out:

You almost always need a Certified Translation for:

- Immigration (USCIS): Any document not in English—bank statements, birth certificates, you name it—must come with a complete, certified English translation.

- Academic Applications: Universities require certified translations of foreign transcripts to accurately assess your grades and credentials.

- U.S. Legal Proceedings: Most American courts will require certified translations of any evidence originally in a foreign language.

You might need a Notarized Translation for:

- Documents Used Abroad: Some countries have strict rules requiring notarization for official papers like adoption documents or legal affidavits.

- Specific Legal Contracts: High-stakes business or real estate deals sometimes have notarization written into the requirements.

- Government Agencies Outside the U.S.: Foreign government bodies often have their own unique bureaucratic demands that include notarization.

The best advice? Always double-check the requirements with the specific institution receiving your documents. They will tell you exactly what level of validation they expect. If you want to dive deeper, you can learn more about certified and notarized translations on our dedicated page. Getting it right the first time is the key to keeping your application process moving forward without a hitch.

Choosing the Right Financial Translation Provider

Picking a partner to translate your sensitive financial documents can be a bit nerve-wracking. Get it right, and you’ll have accuracy, security, and peace of mind. Get it wrong, and you could be facing costly delays, rejected applications, or even legal headaches.

Let's walk through a straightforward checklist to help you choose with confidence.

The decision really boils down to a few key things that separate the pros from the pretenders. If you focus on their expertise, the guarantees they offer, and how they handle security, you can vet providers effectively and protect yourself.

To make this easier, here's a practical table you can use when comparing different services.

Checklist for Selecting a Financial Translation Service

| Evaluation Criterion | What to Look For | Red Flag to Avoid |

|---|---|---|

| Industry Expertise | Translators with proven backgrounds in finance, accounting, or banking. They should understand the jargon. | Vague claims of "professional translators" with no specific financial experience mentioned. |

| Certification Guarantee | An explicit promise to stand behind their work, especially for official submissions (like USCIS). This includes free revisions if an authority questions the translation. | No mention of a guarantee or extra charges for revisions. They should be confident in their accuracy. |

| Security Protocols | Clear policies on data protection, like SSL encryption, secure portals, and mandatory NDAs for all translators. | Fuzzy or non-existent security policies. Your data is too sensitive for guesswork. |

| Transparent Pricing | A clear, upfront quote with no hidden fees. You should know if it's per word, per page, or a flat fee. | Complicated pricing structures or an unwillingness to provide a firm quote before starting. |

| Reliable Turnaround | A firm delivery date and options for expedited service if you're on a tight deadline. | Vague timelines like "as soon as possible" or a history of missed deadlines (check reviews). |

| Quality Control | A multi-step process that includes translation, editing, and proofreading by different qualified linguists. | A "one-and-done" process where a single translator does everything without a second pair of eyes. |

By methodically checking these boxes, you move from hoping you've found a good provider to knowing you have.

Why Deep Financial Expertise is Non-Negotiable

This is the big one. Don't be shy about asking direct questions: Do your translators have real-world finance or accounting experience? A linguist who has also worked as an accountant or financial analyst will get the context behind the numbers. They know that "deferred revenue" or "capital gains" aren't just words—they're precise financial concepts.

This level of specialized knowledge is what makes a true financial translation service different. It's what prevents the subtle but critical mistakes a generalist translator might easily miss, especially in a dense audit report or a complex investment agreement.

Demand Ironclad Security and Guarantees

What happens if an institution like USCIS questions your translated bank statement? A solid provider will stand firmly behind their work with a clear certification guarantee. This means they'll handle any required revisions or clarifications at no extra cost to you.

Think of it as your safety net. It proves the agency is confident in its quality and is invested in your success.

Just as important is security. Financial documents are full of sensitive data, so you need to know it’s being handled with extreme care. Ask about their security protocols:

- How is data protected during upload and transfer? Look for SSL encryption or secure client portals.

- Do translators sign non-disclosure agreements (NDAs)? This should be standard procedure, no exceptions.

- What are your data retention policies? A professional agency will tell you how long they store your files and how they are securely deleted.

The global language services industry was valued at USD 71.7 billion in 2024 and is expected to climb to USD 75.7 billion in 2025. In such a massive market, it's the human-certified work that commands trust for high-stakes documents, where the cost of a single error is just too high.

Using this checklist will help you cut through the noise and find a partner that offers the right mix of expertise, reliability, and security. For more tips, check out our guide on how to choose the right translation service for your industry.

Your Questions About Financial Translation, Answered

When you're dealing with financial documents for immigration, legal matters, or global business, you're bound to have questions. It's a high-stakes area, and getting clear, straightforward answers is essential. Let’s walk through some of the most common questions we hear, so you can move forward with total confidence.

What’s the Real Cost of Financial Translation?

This is usually the first thing people ask. The truth is, there’s no single price tag for financial translation. The cost really depends on what you need translated. Most professional services, including TranslateDay, price things on a per-page or per-word basis to keep it simple and transparent. Our standard rate, for example, is a flat $23 per page, with a page being up to 250 words.

So, what might change that price? A few things:

- Document Complexity: A simple, one-page bank statement is a different beast than a dense, 20-page audit report packed with specialized terminology. The more complex the document, the more work it takes.

- Language Pair: Translating between common languages like Spanish and English is generally more straightforward and cost-effective than working with a rarer language combination.

- Urgency: Need it yesterday? If you require a translation faster than the standard 24-48 hour window, there might be a rush fee to get your project to the front of the line.

The best advice? Always find a provider that gives you clear, upfront pricing information. No one likes surprise fees, and transparency is a great sign you're dealing with a trustworthy company.

How Quickly Can I Get My Translation Back?

Time is almost always a factor, especially when you have a deadline from an institution like USCIS breathing down your neck. For most standard documents—think bank statements or other personal records that are 1 to 3 pages long—a professional service should have a certified translation back to you within 24 hours.

For bigger projects, the timeline naturally extends:

- Short Personal Documents (1-3 pages): Plan on 24 hours.

- Medium-Sized Reports (4-10 pages): This usually takes about 48-72 hours.

- Large Financial Reports (10+ pages): For these, it could be several days, depending on the technical details and total length.

It's always smart to confirm the delivery time right when you request a quote. A reliable service will give you a firm deadline you can bank on.

When you're submitting documents for official use, timing is everything. A provider’s ability to guarantee turnaround times, especially for urgent requests, should be a major factor in your decision.

Is My Confidential Information Actually Safe?

Absolutely. When you're handing over sensitive financial data, security isn't just a feature—it's a necessity. Reputable translation companies build their entire process around protecting your information, from the moment you upload a file to the final delivery.

Here are the key security measures you should expect:

- Secure Sockets Layer (SSL) Encryption: This is the digital equivalent of an armored truck, protecting your data as it travels from your computer to their servers.

- Secure Client Portals: Professionals don't send sensitive files back and forth over email. They use private, password-protected platforms for all uploads and downloads.

- Strict Non-Disclosure Agreements (NDAs): Every single translator and staff member should be legally bound by an NDA, ensuring your information stays confidential.

These protocols are non-negotiable for safeguarding your personal and financial details.

Will My Translated Documents Be Accepted by Official Bodies?

This is the most important question of all. And the answer is a firm yes—if you work with a provider that offers a certified translation and guarantees its acceptance. For any official body like USCIS, a translation is only considered valid if it’s accompanied by a signed Certificate of Translation Accuracy.

This certificate is a formal statement from the translator or agency attesting that the translation is a complete and accurate reflection of the original document. A credible agency will always stand behind its work. If an official body has any questions, the agency should be ready to step in and provide clarification or revisions at no extra cost.

This guarantee is your peace of mind. It ensures the documents you're submitting will meet the rigorous standards of government agencies, courts, and universities. For example, when you need a certified translation for USCIS, this acceptance guarantee means your application won't get held up by translation issues.

At TranslateDay, we provide certified translations you can rely on, with guaranteed USCIS acceptance and clear, upfront pricing. Our secure, 100% online process makes getting the accurate documents you need simple and fast.

Get an instant quote and start your translation in just a few minutes.